Securitization

What is an Asset-Backed Securitization?

Asset-Backed Securitizations involve converting assets with future receivables into marketable securities. This powerful financial tool helps businesses raise capital, enhance liquidity, and manage risk.

Funds

Funds Raised Annually

Our asset-backed securitization services have consistently delivered significant results for our clients. Here is a graphical representation of the funds raised annually, showcasing our growth and impact in the financial sector.

No Data Found

Approach

Our Approach

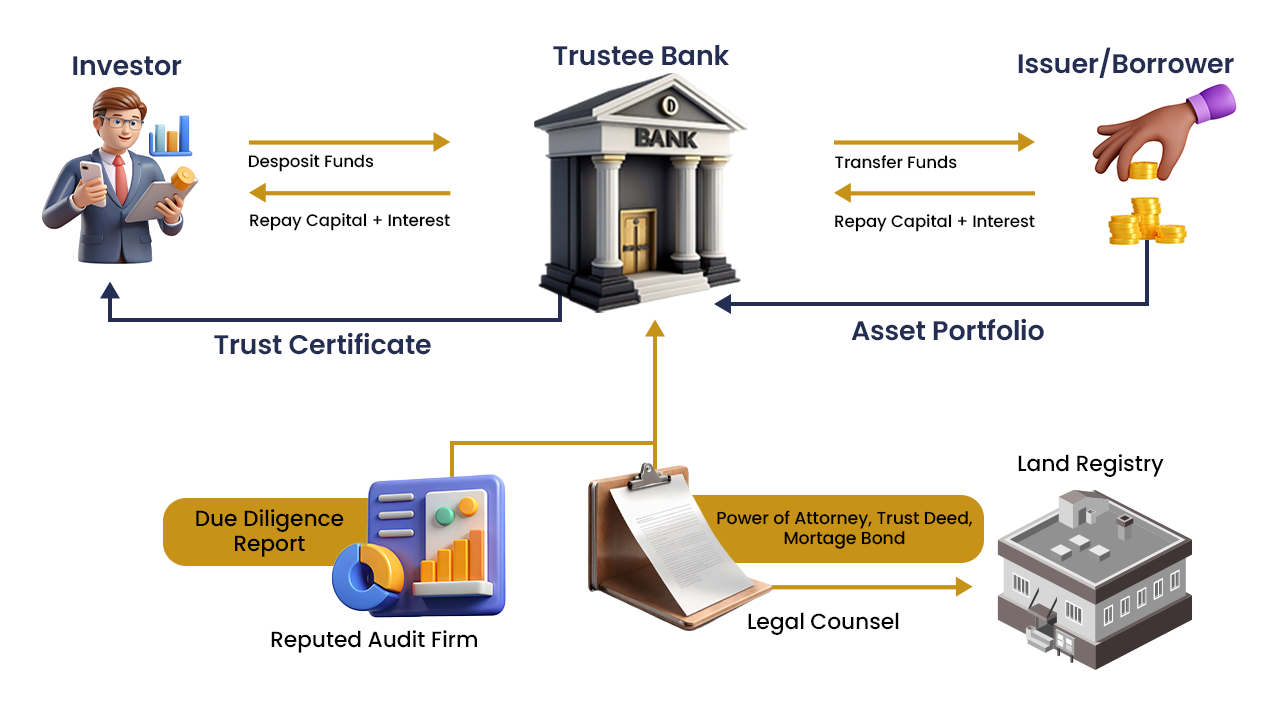

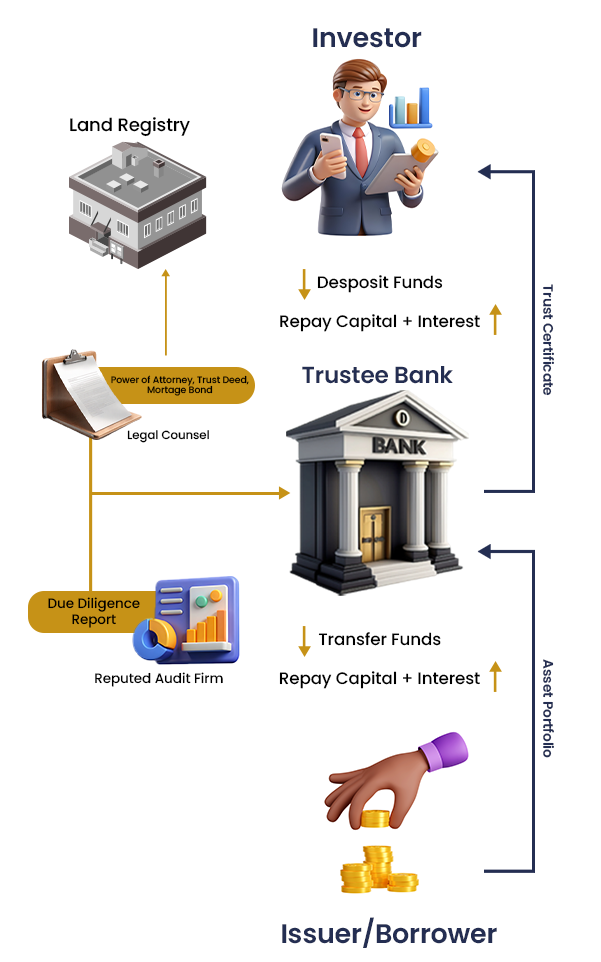

At Capital One Partners, we offer a comprehensive asset-backed securitization service that begins with a detailed assessment of issuer assets and financial goals. We design an asset-backed securitization structure that optimizes financial position and meets the strategic objectives of both issuers and investors.

Benefits

Benefits for our clients

To Investor

The investor will enjoy highly secured assets that are audited by a reputable auditor, with legal formality covered by a Trust Deed, Mortgage Bond, and Special Power of Attorney. The trustee bank is given the ability to act as the custodian by providing acces to the collateral portfolio. Additionally, investors can enjoy high returns with various tenure options.

To Issuer

A novel form of raising capital than the conventional methods by pledging their assets as collaterals with future cash flows, which enables them to tap into a diversified investor market.

Process

The Securitization Process

Process

The Securitization Process

faqs

Frequently Asked Questions

Can I invest any amount?

The minimum investment amount is LKR 1 Million.

What is the minimum tenure to invest?

It depends on the particular structure. Usually, tenure starts from 4 months up to 36 months.

How can I find asset-backed securitizations investment options?

You can connect with us through the website or call us directly.

How secure is it to invest in asset-backed securitizations?

Investment security varies based on asset type, structure, credit quality, and market conditions. To minimize risks, we choose companies with high credit ratings and work with reputed audit companies.

Can I prematurely uplift my investment?

Prematurity is not accommodated in asset-backed securitizations by the issuer as per the trust deed. However, you can sell the trust certificate in the secondary market and we can guide you through this process.

Legal and Compliance

Ensuring Transparency and Security

Power of Attorney

It assigns the issuer’s power to the trustee.

Transactions are governed by a trustee

Mortgage Bond

Collateralized issuer’s assets or receivables

Trust Deed

A trust deed is a legal document that outlines the terms and conditions under which a pool of assets (receivables) is transferred to a trust. This trust then issues securities to investors, with the assets serving as collateral. The trust deed details the rights and obligations of all parties involved, including the trustee, who manages the assets on behalf of the investors. It ensures that the cash flows from the assets are distributed to the investors according to the agreed terms

Testimonials

Trusted by Thousands of Happy Customer

"I am so happy, my dear friend, so absorbed in the exquisite sense of mere tranquil existence, that I neglect my talents. I should be incapable of drawing a single stroke at the present moment."

Oliver Simson

Developer"I am so happy, my dear friend, so absorbed in the exquisite sense of mere tranquil existence, that I neglect my talents. I should be incapable of drawing a single stroke at the present moment."

Mary Grey

Manager"I am so happy, my dear friend, so absorbed in the exquisite sense of mere tranquil existence, that I neglect my talents. I should be incapable of drawing a single stroke at the present moment."